The Import Roadmap: From Factory Floor to Farm Gate

Miscalculating volume displacement or failing biosecurity checks can turn a profitable import into a financial liability. For heavy infrastructure like horse stables, strict adherence to customs protocols is required to avoid demurrage fees and border rejections.

This article details the logistics of importing 42-micron galvanized frames and 10mm HDPE infills that bypass ISPM 15 timber restrictions. We analyze HS Code 7308.90.9090 for duty assessments and explain how flat-pack loading strategies maximize 40HQ container space.

The Import Roadmap: From Factory Floor to Farm Gate

The import roadmap for portable écuries de chevaux involves four critical stages: Manufacturing and QA verification, Ocean Freight logistics, Customs and Biosecurity clearance, and final Inland Transport. Direct factory coordination ensures structural integrity is maintained from the 42-micron galvanized coating inspection at the factory to the final assembly at the farm gate.

Phase 1: Factory Production and Pre-Shipment QA

Before any stable leaves the factory floor, it must pass a rigorous inspection process to ensure it can withstand the journey and future use. This phase acts as the primary quality filter where we verify the durability of materials and the logic of how they are packed.

- ✅ Verification of Hot-Dip Galvanization: We inspect the steel to confirm the protective layer meets the 42-micron standard. Think of this coating as a permanent shield that prevents rust from eating the metal during ocean transit.

- ✅ Material Audit: The team confirms that 10mm HDPE boards are used for the infill rather than wood. This is critical because unlike wood, which swells and shrinks with temperature changes, HDPE remains stable and eliminates thermal expansion issues.

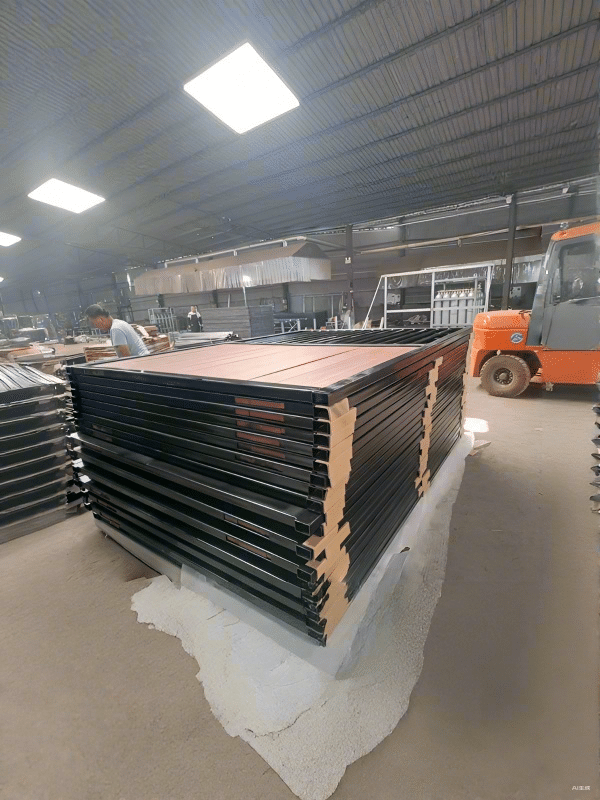

- ✅ Prefabricated Kitting: We pack the 9-part stable panel sets into containers using a precise method. This maximizes the available space and prevents the parts from shifting or sustaining damage while at sea.

Phase 2: Customs Clearance and Biosecurity Standards

Importing agricultural structures into countries with strict biosecurity laws, such as Australia and New Zealand, requires careful planning. The materials used in construction play a massive role in how quickly a shipment clears quarantine.

- ✅ Biosecurity Compliance: Wood is porous and can hide pests, which triggers intense scrutiny at the border. Steel and HDPE are non-porous and lessen the risk of harboring insects, smoothing the path through quarantine inspections.

- ✅ Documentation: Clearing granges préfabriquées requires specific paperwork that matches the physical cargo exactly. Accurate descriptions prevent administrative delays at the port of entry.

- ✅ Supply Chain Transparency: We use standardized data elements aligned with logistics frameworks to track the status of the shipment. This ensures you know exactly where your stables are at any given moment.

How DB Stable Streamlines the Import Process

Navigating international logistics can be complex for first-time importers. DB Stable uses years of direct experience to simplify the transition from the manufacturing plant to your property.

- ✅ Direct Factory Export: We have been exporting to Australia and New Zealand since 2013. This long history helps us anticipate potential logistics hurdles and manage them proactively.

- ✅ Speed and Efficiency: By managing the supply chain directly from China without middlemen, we achieve delivery in record time. This direct line of communication speeds up every step of the process.

- ✅ Installation Support: Notre service extends beyond the drop-off. We provide assistance with the setup of the 40x40mm square metal tube connections and frames, ensuring the final structure is as solid as intended.

Understanding Incoterms: FOB vs. CIF vs. DDP

Incoterms dictate the precise transfer of risk and cost between trading partners. FOB (Free On Board) ends seller liability once goods board the vessel; CIF (Cost, Insurance and Freight) requires the seller to cover transport and insurance to the destination port; while DDP (Delivered Duty Paid) places maximum responsibility on the seller, covering all costs including import duties and final delivery.

| Incoterm | Risk Transfer Point | Freight & Insurance Payer | Import Duty Liability |

|---|---|---|---|

| FOB (Free On Board) | At origin port (Ship’s Rail) | Buyer | Buyer |

| CIF (Cost, Insurance, Freight) | At origin port (Ship’s Rail) | Seller | Buyer |

| DDP (Delivered Duty Paid) | At destination door | Seller | Seller |

Defining the Standards: The 2020 Revision Context

International commerce relies on standardized rules to prevent confusion between buyers and sellers from different legal systems. Think of Incoterms as the rulebook for a relay race, defining exactly where the baton of responsibility passes from one runner to the next. The current framework includes 11 specific clauses. Seven of these apply to any mode of transport, while four are restricted strictly to sea and inland waterway freight.

The 2020 revision represents the 9th edition of these rules. It modernized regulations to better suit containerized shipments. A key change was renaming DAT (Delivered at Terminal) to DPU (Delivered at Place Unloaded). This adjustment reflects actual logistics practices where goods are often unloaded at a specific site rather than a formal terminal. While FOB, CIF, and DDP remain the most active terms, the 2020 update introduced stricter security obligations and clearer cost allocations to reduce disputes.

Technical Comparison: Allocation of Risk and Cost

Choosing the correct term determines who pays for shipping and who is liable if goods are damaged. This distinction is critical for financial planning and risk management.

- FOB (Sea-Only): Risk transfers the moment goods pass the ship’s rail at the origin port. The buyer typically acts as the ISF importer for security filing, giving them control over the ocean freight provider.

- CIF Obligations: The seller pays for the main carriage and insurance to the named destination port. However, the risk of loss or damage transfers to the buyer as soon as the goods are on the ship. Note that CIP now requires Institute Cargo Clause A for comprehensive coverage, whereas CIF often defaults to minimum coverage.

- DDP Liability: The seller assumes the role of the importer of record. This means the seller handles customs clearance, pays all import duties, and manages final delivery. This places the maximum operational burden on the exporter.

Strategic Application and Regulatory Constraints

Importers must weigh convenience against control and legal feasibility. Not every Incoterm works in every country due to local laws.

- Jurisdictional Barriers: DDP is not universally viable. For instance, Brazil prohibits DDP for imports, and Mexico often requires CIF contracts to be declared as FOB for specific import tax calculations.

- Insurance Restrictions: Multiple countries restrict foreign insurance companies from covering post-entry transport. This makes executing DDP legally complex in certain regions.

- Selection Strategy: FOB is generally preferable for buyers who want full control over ocean freight costs and carrier selection. DDP offers a turnkey solution but can expose sellers to complex foreign tax liabilities.

How DB Stable Streamlines Logistics for AU/NZ Importers

Importing large-scale infrastructure requires precise logistics planning. DB Stable has managed exports to Australia and New Zealand since 2013, helping clients navigate the choice between managing their own freight (FOB) or opting for handled delivery.

Our portable écuries de chevaux are built with heavy hot-dip galvanized steel frames that exceed 42 microns in coating thickness. This ensures longevity against rust but also adds significant weight to the shipment. Because freight costs for containerized shipments are often weight-based, selecting the right Incoterm is vital for cost control.

We assist clients in defining clear handover points. This ensures that the HDPE boards and prefabricated panels arrive safely without unexpected duty fees or gaps in insurance coverage. Whether you prefer to pick up at Chinese ports or require assistance with logistics, we align the shipping terms with your operational capabilities.

Navigating Customs Clearance, Duties & Taxes

Customs clearance hinges on entry value thresholds. Shipments under $800 USD often qualify for De Minimis (duty-free), while goods over $2,500 USD require formal entry and incur the Merchandise Processing Fee (MPF). Proper documentation helps importers leverage Periodic Monthly Statements (PMS) to delay duty payments by up to 45 days.

Entry Value Thresholds and Processing Fees

Importing goods requires navigating specific value limits that determine how customs processes your shipment. Think of this like a toll road where smaller vehicles pass quickly, but heavy transport requires a detailed weigh-in and fee payment.

- ✅ Informal vs. Formal Entry: Shipments valued between $0 and $2,500 USD generally pass through as informal entries with less paperwork. Goods exceeding $2,500 USD trigger formal entry requirements.

- ✅ Merchandise Processing Fee (MPF): Formal entries must pay this user fee. It is calculated at an ad valorem rate of 0.3464%. The fee has a floor of $29.66 and a ceiling of $575.35 per entry.

- ✅ Exceptions: A separate formal entry is required for goods between $801 and $2,500 USD if they involve licensed goods, alcohol, tobacco, or are subject to specific trade duties.

Optimizing Costs with Incoterms and Deductions

You can legally reduce the dutiable value of your shipment by separating product costs from logistics costs. If your invoice lumps everything together, customs taxes the total amount. By clarifying these costs, you pay duty only on the goods themselves.

- ✅ Nondutiable Charges: Importers can deduct transportation and insurance costs from the dutiable value if using terms like FOB or FCA, rather than CIF where freight is included.

- ✅ Verification Rule: Customs does not accept estimates. Only “actual” costs verified by carrier freight bills qualify for deduction.

- ✅ Incoterm Revisions: These international trade terms are reviewed every 10 years. The 2010 and 2020 revisions currently dictate responsibilities for buyers and sellers.

Managing Cash Flow with Periodic Monthly Statements

The Periodic Monthly Statement (PMS) system acts like a credit card for duties. Instead of paying immediately upon every shipment arrival, you consolidate payments into one monthly transaction to keep cash available for other business needs.

- ✅ Payment Cycle: Under PMS processing, importers pay duties on the 15th business day of the month following the release of goods.

- ✅ Liquidity Benefit: This mechanism extends payment terms significantly, shifting from the standard 10-day requirement to a 30-45 day window.

- ✅ Documentation Burden: To utilize these benefits, commercial invoices are mandatory for all shipments over $800 USD to prevent release delays and ensure audit compliance.

Importing Heavy Equipment: The DB Stable Approach

When importing substantial infrastructure like portable écuries de chevaux, the value almost always exceeds the formal entry threshold. DB Stable prepares documentation to ensure this process is smooth and cost-effective for clients in Australia and New Zealand.

- ✅ High-Value Freight: Portable horse stables typically exceed the $2,500 USD threshold, making formal entry and MPF calculations standard procedure for these imports.

- ✅ Documentation Support: DB Stable provides detailed commercial invoices and verified weight lists. This supports “actual cost” deductions for freight, ensuring you do not overpay on duties.

- ✅ Structural Compliance: Accurate descriptions prevent penalty fees. We specify that our steel is hot-dip galvanized over 42 microns to align with correct HS code classifications.

Engineered for Safety: Durable Stables for Any Climate

Protect your horses with modular stables designed to withstand extreme weather conditions and meet international compliance standards. Our hot-dipped galvanized steel frames and customizable infill options ensure superior rust resistance, ventilation, and long-term durability for facilities worldwide.

Essential Documentation (HS Codes)

The Harmonized System (HS) is a standardized 6-digit classification framework governed by the World Customs Organization (WCO), covering 98% of international trade across 200+ countries. It serves as the foundation for determining tariff rates, verifying origin eligibility, and tracking trade statistics. Importers must ensure these codes appear correctly on commercial invoices and customs declarations to avoid border delays.

The WCO Harmonized System Architecture

The system follows a three-tier decomposition established by the WCO in 1988. You can think of this like a universal library cataloging system where every item has a specific place on a shelf. The code starts broad and gets increasingly specific with each pair of numbers added to the sequence.

- ✅ Chapters (First 2 digits): Identify 99 broad categories of merchandise, similar to the main sections of a library like “History” or “Science.”

- ✅ Headings (First 4 digits): Specify the product type within approximately 1,244 distinct headings, narrowing down the category.

- ✅ Subheadings (First 6 digits): Provide maximum precision with roughly 5,224 classifications available in the HS 2022 revision.

National Variations: HTS and TARIC Extensions

While the first 6 digits are universal, individual countries add suffixes for local tariff calculation and tracking. Imagine the first six numbers as your street address which everyone agrees on, while the extra numbers added by specific countries are like an apartment number required for final delivery.

- 🌐 United States: Uses the 10-digit HTS (Harmonized Tariff Schedule) for import duties and the Automated Export System (AES) for shipments valued over $2,500.

- 🌐 India: Extends the code to 8 digits for local classification needs.

- 🌐 EU and UK: Utilize systems like TARIC that extend up to 10 digits for specific compliance and duty requirements.

Compliance Protocols and GRI Standards

Classification follows the General Rules of Interpretation (GRI). These act as the referee’s rulebook when a product is difficult to categorize. For example, if a portable stable is shipped as a kit of parts, GRI 2 allows it to be classified as the finished product rather than just a pile of steel and plastic. GRI 3 focuses on the “essential character” of the item if it falls under multiple descriptions.

Codes must appear on key commercial instruments including Commercial Invoices, Packing Lists, and Certificates of Origin. Incorrect coding risks audit penalties or seizure, particularly when customs officials struggle to distinguish between raw materials like steel versus finished products like prefabricated buildings.

How DB Stable Facilitates Export Compliance

DB Stable has exported to Australia and New Zealand since 2013, establishing deep experience with specific import requirements for these regions. By ensuring the proper classification of “prefabricated portable horse stables,” the company helps buyers receive accurate duty assessments without surprise fees.

This attention to detail in documentation complements the physical quality of the product, such as the hot-dip galvanized steel frames. Customers frequently report that goods are “delivered in record time,” which suggests that the export documentation and customs formalities are handled efficiently to prevent border holds.

Flat-Pack Logistics: Maximizing Container Space

Flat-pack logistics reduces shipping costs by minimizing volume displacement, achieving up to a 24:1 increase in units per truckload compared to rigid containers. By shipping collapsed packaging (like bag-in-box liners) rather than assembled units, businesses can fit up to 4 flat-pack containers in the space of one standard 20-foot container, significantly optimizing freight and warehouse density.

Volume Displacement and Space Multiplication

The concept of volume displacement in shipping is similar to packing a suitcase. If you pack an inflated beach ball, it takes up significant room. If you deflate it, it takes up almost no space. Flat-pack logistics applies this principle to industrial shipping, removing the “air” from the equation to maximize the number of units transported in a single trip.

- ✅ Space Multiplication Factor: A specific soy sauce case study demonstrated a 24:1 increase in packaging units per truckload, scaling from 3,000 rigid containers to 72,000 flat-packed liners.

- ✅ General Advantage: Flat-packing offers a 3:1 space-saving advantage over semi-rigid cube containers in typical applications.

- ✅ Container Ratios: Up to 4 flat-pack containers can fit into the footprint of a single standard 20-foot shipping container.

Warehouse Density and Stacking Protocols

Efficiency gains extend beyond the shipping vessel and into the warehouse. When products arrive flat-packed, they require significantly less floor space, allowing facilities to hold higher inventory levels without expanding their physical footprint. To maintain safety, specific stacking rules must be followed to prevent damage to the cargo.

- ✅ Warehouse Efficiency: Facilities can store 72,000 flat-packed units in the same physical footprint previously required for just 3,000 assembled containers.

- ✅ Vertical Stacking Rule: Heavier items must be positioned at the container base with lighter items on top to prevent crushing.

- ✅ Floor-to-Ceiling Utilization: Packages in floor-loaded containers should be stacked fully from floor to ceiling to minimize cargo movement during transit.

- ✅ Securing Mechanisms: Use metal straps or bars to maintain load integrity in le respect des normes de sécurité.

How DB Stable Leverages Portability in Logistics

At DB Stable, we apply these volume-saving principles to the equine industry. Traditional stables are bulky and difficult to transport, but our approach uses a prefabricated design that separates components like our hot-dip galvanized frames and HDPE boards. This allows us to ship high-quality horse stables efficiently from our factory to clients in Australia and New Zealand.

- ✅ Prefabricated Design: DB Stable utilizes a prefabricated barn model that emphasizes quality, flexibility, durability, security, and portability, allowing for efficient shipping to Australia and New Zealand.

- ✅ Optimized for Export: As a direct factory exporting since 2013, the portable horse stable design ensures units can be transported economically, similar to the space-saving principles of flat-pack logistics.

- ✅ Rapid Delivery: Customer feedback confirms the efficacy of this logistics approach, with clients noting orders were delivered in record time.

Managing Exchange Rate Risks

Managing exchange rate risks involves three primary methodologies: the Currency Adjustment Factor (CAF), building rates, or using daily market-based rates. While CAF often applies a flat surcharge, market-based rates utilize real-time interbank data for transparency. Advanced strategies include hedging with forward contracts and options to lock in costs against currency fluctuation.

Primary Methodologies: CAF vs. Market-Based Rates

When importing goods like heavy-duty manufacturing equipment or portable horse stables, the method used to calculate currency exchange can significantly alter the final invoice. You generally encounter three standard approaches for handling these fluctuations.

- Currency Adjustment Factor (CAF): This is a flat percentage surcharge applied uniformly to an invoice. Ideally, it acts as a buffer for the carrier. But in practice, it often functions like a fixed service fee that remains high even if the actual exchange rate improves. For example, a 10% surcharge might apply to shipments from Japan to the U.S. regardless of daily market shifts.

- Building Rates: Some logistics providers incorporate a risk premium directly into the base freight charge. This offers cost certainty because the price does not change day-to-day. The downside is that you are permanently paying for that safety net, similar to buying insurance you might not always need.

- Daily Market-Based Rates: This is generally the most accurate method for importers. It applies interbank rates from authoritative sources like the Wall Street Journal or Oanda based on specific dates, such as the day the ship departs or the invoice date. This transparency ensures you pay the real market price.

Hedging Instruments and Financial Clauses

For businesses dealing with large volumes, simply accepting the market rate can be risky. Financial hedging acts as a shield for your capital, much like how we use hot-dip galvanization (over 42 microns) to shield our steel frames from physical rust. Both strategies prevent external elements from eroding value over time.

- Currency Escalation Clauses: Contracts can trigger automatic price adjustments if rates move too far. For instance, a clause might state that if the currency shifts by more than 5%, the price increases by 50% of that movement. This shares the risk between buyer and seller rather than placing it all on one party.

- Window Forward Contracts: These are ideal when you are unsure of the exact payment date. Instead of locking in a rate for a single day, you lock it in for a window of time. Think of it like a flexible delivery slot for your goods; you have a range of dates to settle the transaction without penalty.

- Derivatives: These are advanced financial tools like swaps and options used to hedge broader risks. They function like an insurance policy for your money, allowing you to limit potential losses if the currency market takes a sudden downturn.

Strategic Implementation and Best Practices

Operationalizing risk management requires removing emotional guesswork from the process. Large volume shippers can accumulate hundreds of thousands of dollars in adjustments if they rely on intuition rather than data.

- Automated Triggers: Modern systems monitor rates in real-time. You can set a rule that executes a hedge transaction the moment a specific threshold is crossed. This ensures protection is in place instantly, without waiting for human approval.

- Standardized Protocols: To avoid disputes, contracts should specify exactly which rate source and conversion date will be used. This creates a clear audit trail. Just as we standardize our 10mm HDPE boards to ensure every stable fits perfectly, your financial contracts need precise standards to ensure the numbers always align.

- Financial Impact: Selecting the right methodology is critical. For a business importing high-value assets, the difference between a flat CAF and a market-based rate can equal the cost of an entire additional container of stock over a year.

Handling Inland Transport and Unloading

Inland transport operations rely on a dual-layer protection strategy combining physical equipment standards like DN 100/150 loading arms and 2-inch Kamlok® couplers with strict procedural safeguards. Operators must adhere to electrostatic flow restrictions (max 75% capacity) and mandatory earthing protocols to prevent static discharge during the transfer of flammable products.

Loading Arm Specifications and Vapor Recovery

Safe transport begins with the physical equipment used to transfer materials. The industry standard utilizes loading arms with diameters of DN 100 and DN 150, which translates to 2 and 6 inches respectively. These arms are designed with counter-balances, acting much like a weighted seesaw, to reduce the physical strain on operators during connection and disconnection.

Controlling the speed of the transfer is just as critical as the hardware size. To prevent the build-up of static electricity, flow rates are strictly limited. Think of this like pouring water into a glass; if you pour too fast, it splashes and creates turbulence. In fuel transport, that turbulence creates static charge, so the flow is capped at 75% of the system’s maximum capacity.

- Vapor Management: Manifold systems act as a capture net, handling simultaneous loading of up to 4 compartments to trap fumes before they escape.

- Overfill Prevention: Sensors act as an automatic brake, installed on loading arms or tanks to stop flow immediately if liquid levels get too high.

Unloading Hardware and Coupling Standards

The unloading process relies on specific hardware to ensure a secure connection between the transport vehicle and the storage facility. The standard connection point typically involves 2-inch Kamlok® style quick couplers located at the rear of the trailer. These function like heavy-duty garden hose connectors that snap into place securely without requiring complex tools.

Preventing environmental contamination is a priority during this phase. Vehicles are required to use dry-break couplings. You can imagine these as self-sealing valves that automatically close off both ends of the hose the moment they are disconnected, ensuring that not even a few drops of product spill onto the ground.

- Pressure Safety: Trailers are equipped with relief devices that act like safety valves on a pressure cooker, venting excess pressure to prevent structural failure.

- Discharge Systems: The setup distinguishes between vapor recovery on the loading side and specific unloading tools like bottom discharge systems and desiccant dryers.

Operational Safety and Verification Protocols

Even the best equipment requires strict human oversight to function safely. The most critical step for flammable products is static mitigation through earthing. This involves connecting the vehicle to a grounding point, creating a safe path for static electricity to dissipate into the earth rather than sparking near the fuel.

Before any transfer begins, drivers must stage the vehicle correctly. This goes beyond simply parking; it involves setting the brakes and placing wheel chocks to physically block the tires, ensuring the massive vehicle cannot shift during the transfer.

- Pre-Operation Verification: Operators verify the tank has enough empty space (ullage) and that all grounding cables are connected before opening any valves.

- Disconnection Rules: To prevent accidents, operators must verify that all valves are closed and hoses are depressurized before attempting to uncouple them.

Logistics and Unloading Support for DB Stable Structures

While liquid transport focuses on pressure management and static control, the logistics for solid structures like DB Stable prefabricated barns focus on physical integrity and efficient assembly. Unlike liquid cargo that is pumped out, these heavy modular components require careful mechanical unloading to preserve their finish and structure.

The structural integrity of these stables is secured long before they reach the site. DB Stable utilizes hot-dip galvanized steel frames with a 42-micron thick coating. This creates a metallurgical bond that acts as a permanent shield against rust and abrasion during the shifting and vibration of transport.

- Structural Integrity: The 40x40mm square metal tubes are fully welded with 6mm steel plates, ensuring the frame remains rigid and square upon arrival.

- Secure Packaging: Specialized handling protects the 10mm HDPE boards, which are UV-resistant, ensuring they arrive without scratches or thermal warping.

- Installation Assistance: Beyond simple delivery, DB Stable provides guidance on setup, helping clients transform the flat-packed components into functional stables quickly.

- Speed and Efficiency: Clients frequently report delivery in record time, necessitating efficient unloading protocols to handle the heavy steel components safely.

Biosecurity Compliance (Timber vs. Synthetic)

Biosecurity compliance distinguishes between high-risk timber and low-risk synthetic materials in international logistics. Timber packaging requires strict adherence to ISPM 15 standards, including certified heat treatment and fumigation, to prevent pest entry. Synthetic alternatives, such as HDPE and wood plastic composites, generally bypass these rigorous certification mandates, offering a streamlined import process for strict markets like Australia and New Zealand.

When importing structures into countries with strict biosecurity laws, the material you choose dictates the difficulty of the customs process. Natural timber acts like a biological sponge that can harbor pests, leading to strict regulations. Synthetic materials typically bypass these hurdles because they are inorganic and sterile by design.

| Compliance Factor | Bois traditionnel | Synthetic (DB Stable) |

|---|---|---|

| Pest Risk | High (Insects, pathogens, spores) | Minimal (Inorganic material) |

| ISPM 15 Requirement | Mandatory Certification | Generally Exempt |

| Required Treatments | Heat Treatment / Fumigation | None (Sterile by manufacture) |

| Dédouanement | Complex documentation needed | Streamlined entry |

The Biosecurity Risk Gap: Organic vs. Synthetic

The primary reason customs authorities scrutinize timber is its organic nature. Just as food left on a counter attracts ants, raw wood provides food and shelter for insects and microscopic diseases. Timber poses a high biosecurity risk because it can carry beetle larvae deep inside the grain or fungal spores on the surface, especially if sapwood is present.

In contrast, regulatory authorities classify synthetic alternatives as low risk. Materials like reconstituted wood or Wood Plastic Composites (WPC) undergo high heat and pressure during manufacturing. You can think of this manufacturing process as a built-in sterilization method. Since the material is essentially cooked and compressed into a dense solid, it cannot support life or hide pests the way natural wood does.

- Inherent Risk: Timber requires debarking and chemical intervention to become safe.

- Engineered Safety: Synthetics rely on their production process to mitigate infestation risks naturally.

ISPM 15 Standards and Treatment Protocols

To mitigate the risks associated with wood, international trade relies on ISPM 15 standards. Think of this as a mandatory passport for wood packaging. Without the proper stamp proving it has been treated, the wood cannot enter countries like the US or Australia. The goal is to ensure that any pests living inside the wood are exterminated before the cargo ships out.

The treatment protocols are specific and rigorous. Wood packaging must be heat-treated so the core temperature reaches a specific level for a set time, or it must be fumigated with approved chemicals. There are also strict size limits. Generally, timber components must not exceed 200mm in thickness. If a piece of wood is too thick, the heat or gas cannot penetrate to the center effectively, leaving a safe haven for pests.

- Moisture Limits: Wood must be dried to below 20% moisture content to prevent mold and fungal growth during transit.

- Prohibited Items: Certain high-risk items, such as Coconut timber exceeding 200mm, are often completely banned from entry into Australia.

- Verification: All treatments must be verified and marked clearly on the packaging material.

How DB Stable Aligns with Import Standards

DB Stable designs portable horse stables to align with these import standards by selecting materials that are naturally compliant. Instead of solid timber planking, we utilize 10mm UV-resistant HDPE boards for stable infills. Because HDPE is a high-density plastic, it is immune to the organic risks that plague timber. It does not rot, hold moisture, or provide a home for termites.

The structural framework further simplifies compliance. We use hot-dip galvanized steel frames with a coating exceeding 42 microns. Think of galvanization as a permanent metal skin that seals the steel. This inorganic structure is invisible to pests and requires no fumigation or heat treatment certification. Since 2013, this material strategy has allowed our products to navigate the strict biosecurity requirements of Australian and New Zealand ports much faster than traditional timber barns.

- Material Selection: HDPE infills eliminate the need for bark removal or insect treatment documentation.

- Steel Immunity: Hot-dip galvanized frames are exempt from ISPM 15 because steel cannot harbor plant diseases.

- Market Focus: The design specifically targets the streamlined entry requirements of strict biosecurity regions.

Dealing with Delays

Import clearance delays typically range from 24 hours to several weeks, driven by factors like incomplete documentation or regulatory non-compliance. The most critical preventable cause is missing the Import Security Filing (ISF) window, which must occur 24 hours before vessel departure. Mitigating these delays requires strict alignment of HTS codes across Commercial Invoices and CBP forms to avoid costly warehousing fees and supply chain disruptions.

Root Causes: Preventable vs. Inspection-Based Holds

Most shipping delays fall into two distinct categories. Understanding the difference helps you identify if a hold is a simple error or a mandatory regulatory step. Delays can last anywhere from a single day to several weeks depending on the complexity of the issue.

- Preventable Delays: These stem from human error. Common issues include the Importer of Record (IOR) declaring incorrect values or a freight forwarder missing the Automated Manifest System (AMS) filing.

- Inspection-Based Delays: These are regulatory checks. While often mandatory, the duration extends significantly if the initial paperwork does not perfectly match the physical goods.

- Control Entities: Three groups manage this timeline. The IOR sets requirements, the forwarder handles filings, and the compliance team verifies data.

The 24-Hour Rule and Documentation Standards

Customs authorities operate on strict timelines. The most significant of these is the “24-Hour Rule,” which acts as a hard deadline for maritime security. Missing this window triggers automatic holds that are difficult to reverse.

- ISF Pre-Filing Window: The Import Security Filing (ISF) must be submitted at least 24 hours before the vessel leaves the port of origin.

- Data Consistency: Every detail must align perfectly. The item descriptions, quantities, and values on the Commercial Invoice must match the Packing List and CBP Forms 7501 and 3461.

- Classification Accuracy: Errors in Harmonized Tariff System (HTS) codes attract audits. Think of the HTS code as a universal ID number for your product; if the ID does not match the item, customs will stop the shipment.

- Pre-Arrival Verification: Compliance teams review these documents before goods arrive at the port to ensure the Pre-Arrival Filing is accepted immediately.

Financial Impact and Operational Risks

A delay at the port costs more than just time. When containers sit idle, they generate compounding fees and lock up financial resources that could be used elsewhere in the business.

- Working Capital Lockup: Inventory remains unsold in a container while you continue to pay suppliers and shipping carriers.

- Direct Costs: Ports charge daily fees for storage, known as demurrage, which escalate quickly. Importers may also face fines for non-compliance.

- Product Integrity: Time-sensitive goods face quality risks. Even durable goods can suffer if port conditions are poor, turning a logistical delay into a liability loss.

- Risk Mitigation: Implementing origin-based controls and physical inspections before the ship leaves reduces the chance of targeted inspections upon arrival.

How DB Stable Minimizes Export Latency

We use our experience as a direct factory to prevent common shipping delays for our clients in Australia and New Zealand. By managing the entire process internally, we remove the communication gaps that often cause paperwork errors.

- Direct Factory Control: Operating since 2013, we handle all origin-based documentation in-house to ensure it is accurate before the ship departs.

- Documentation Accuracy: We ensure all export forms specifically detail our materials, such as the 42-micron hot-dip galvanization on our steel frames. This precision prevents customs officials from questioning the material classification.

- Proven Track Record: Our clients frequently report that orders are delivered in record time, avoiding the industry-standard delays often caused by third-party trading agents.

- Professional Coordination: Our dedicated export team coordinates all pre-shipment requirements, ensuring that form data matches the physical cargo exactly to avoid preventable holds.

Questions fréquemment posées

What is the HS Code for prefabricated horse stables?

The primary HS Code for these structures is 7308.90.9090. This classification applies to iron or steel structures and typically carries a standard duty rate of 5.7 percent. This code assumes the product is made mostly of galvanized steel.

You may be able to import these duty-free under provision 9817.00.50. This is a special classification for machinery and equipment used in agriculture. To qualify, you usually need to submit an Actual Use Certification to douanes proving that the stables are for agricultural purposes.

Should I choose FOB or CIF for my first stable import?

We recommend CIF (Cost, Insurance, and Freight) for first-time buyers. Under this agreement, the seller manages the logistics, insurance, and risk until the goods arrive at your destination port. This is safer because the supplier handles the complex shipping arrangements.

While FOB (Free on Board) often appears cheaper on the initial invoice, it requires you to negotiate freight and insurance yourself. For a new importer, the predictability of CIF is worth the small premium. It functions like an all-inclusive price where the seller ensures the product reaches your local port safely.

How many horse stalls fit in a 40HQ container?

A 40-foot High-Cube container offers about 76.4 cubic meters of usable space. The exact number of stalls depends on their dimensions, such as standard 10×10 foot or 12×12 foot models, and how efficiently they are flat-packed.

Manufacturers like DB Stable optimize loading plans to fit the maximum number of units into this volume without exceeding the 28,500 kg weight limit. You should always request a specific loading plan from your supplier to get an accurate count for your order size.

What documents are required for customs clearance?

Every shipment requires three core documents: the Commercial Invoice, the Bill of Lading (or Air Waybill), and the Packing List. Customs officials use these to identify what you are importing and its value.

Additional filings may be necessary depending on the specifics. For example, U.S. imports arriving by ocean freight require an Importer Security Filing (ISF). If you claim duty preferences under a trade agreement, you will also need a Certificate of Origin.

How do I calculate the total landed cost?

The total landed cost is the sum of the product cost, freight, customs duties, VAT, insurance, and overhead. It represents the true cost to get the item to your door, not just the factory price.

When calculating taxes, note that VAT is often applied to the combined value of the goods plus the duty amount. You should also budget for hidden overheads like customs brokerage fees and harbor maintenance fees, which are easy to overlook.

Do synthetic stable materials require fumigation certificates?

No, synthetic materials do not require fumigation certificates. These certificates are strictly for raw wood packaging to prevent the spread of pests like beetles. Synthetic infills and processed woods like plywood are exempt from ISPM 15 regulations.

Using synthetic stables simplifies customs clearance because you avoid the risk of delays caused by non-compliant wood packaging. This is a significant logistical advantage over traditional raw timber stalls.

Réflexions finales

Importing agricultural infrastructure demands precision in logistics and compliance, not just a purchase order. A single error in biosecurity documentation or HS code classification can turn a cost-effective investment into a financial liability through port delays and compounding storage fees.

Prioritizing compliant materials like synthetic HDPE and 42-micron galvanized steel eliminates the inspection risks that frequently ground timber shipments. Partnering with a manufacturer experienced in export protocols ensures your stables arrive duty-optimized and ready for immediate installation.

0 commentaires